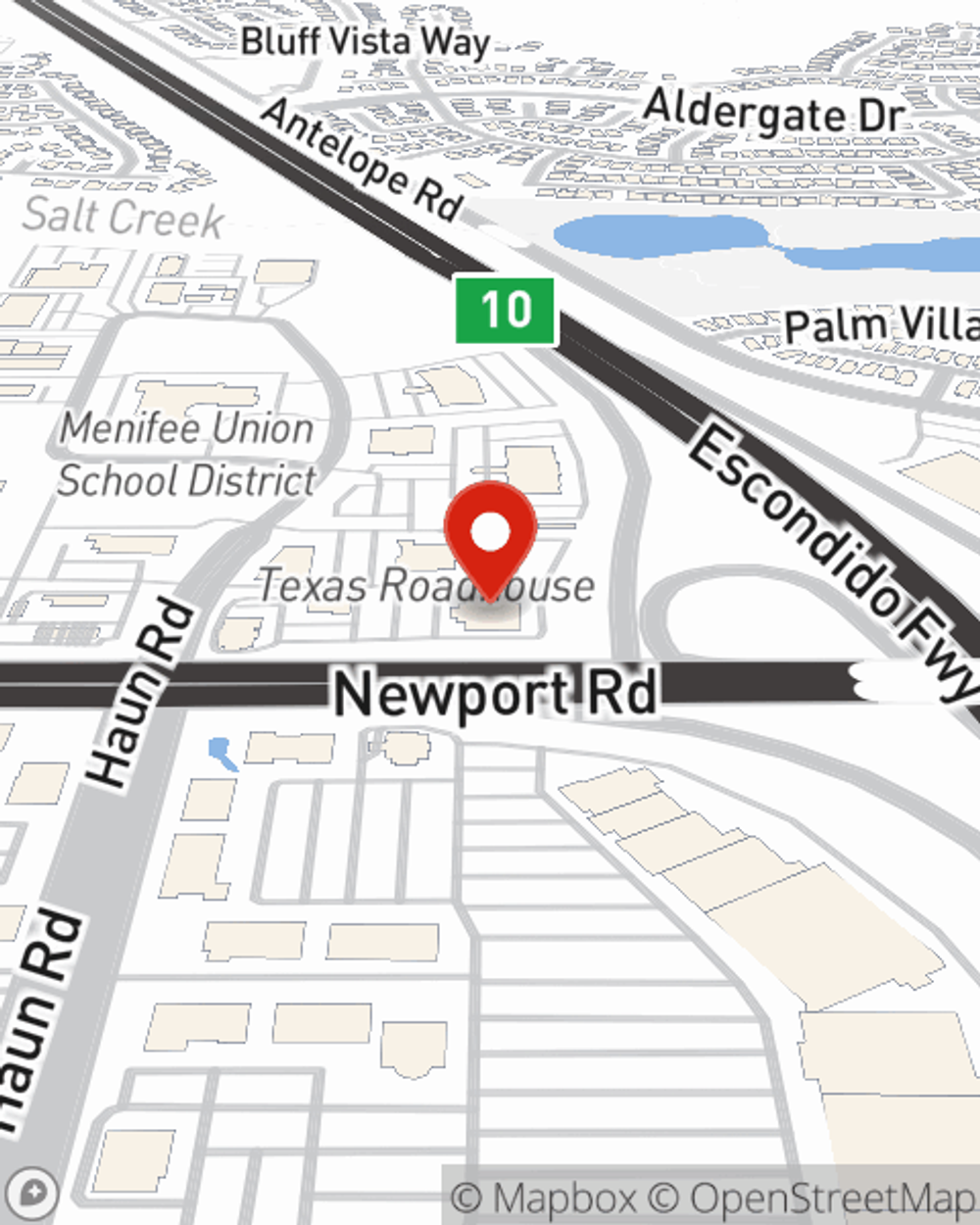

Life Insurance in and around Menifee

State Farm can help insure you and your loved ones

What are you waiting for?

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

When you're young and a recent college graduate, you may think Life insurance isn't necessary when you're still young. But it's a perfect time to start talking about Life insurance to prepare for the unexpected.

State Farm can help insure you and your loved ones

What are you waiting for?

Love Well With Life Insurance

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with coverage for a specific number of years coverage for a specific time frame or another coverage option, State Farm agent Sonia Avalos can help you with a policy that can help cover your loved ones.

As a trustworthy provider of life insurance in Menifee, CA, State Farm is committed to protect those you love most. Call State Farm agent Sonia Avalos today and see how you can save.

Have More Questions About Life Insurance?

Call Sonia at (951) 723-1900 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Sonia Avalos

State Farm® Insurance AgentSimple Insights®

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.